Introduction to Green Energy Tax Credits

In an era where climate change and environmental sustainability have taken center stage, the importance of green energy tax credits cannot be overstated. These incentives are designed to encourage individuals and businesses to invest in renewable energy sources and technologies. In this guide, we will delve into the various types of green energy tax credits available, their benefits, and how you can take advantage of them.

What Are Green Energy Tax Credits?

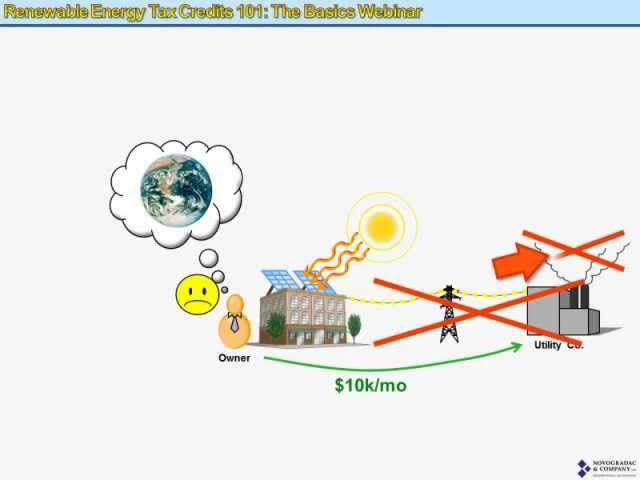

Green energy tax credits are financial incentives provided by federal, state, and local governments to promote the use of renewable energy. They reduce the amount of tax you owe based on the cost of installing renewable energy systems, such as solar panels, wind turbines, and geothermal systems. The primary goal is to make green energy solutions more accessible and affordable for everyone.

The Importance of Green Energy Tax Credits

Tax credits play a crucial role in the adoption of renewable energy technologies. Here are some reasons why they are important:

- Financial Savings: They can significantly lower the upfront costs associated with renewable energy installations.

- Encouragement of Sustainable Practices: Tax credits incentivize individuals and businesses to adopt more sustainable energy practices.

- Reduction of Carbon Footprint: By promoting renewable energy, tax credits help reduce greenhouse gas emissions.

- Economic Growth: The green energy sector creates jobs and stimulates economic growth.

Types of Green Energy Tax Credits

There are several types of green energy tax credits available to taxpayers. Understanding these can help you identify which ones you may qualify for.

1. Federal Investment Tax Credit (ITC)

The Federal Investment Tax Credit (ITC) is one of the most significant incentives available for renewable energy systems. Here are some key points:

- Applicable to solar, wind, geothermal, and fuel cell systems.

- Offers a tax credit of up to 26% of the installation costs for systems installed before 2023.

- The credit percentage is scheduled to decrease in subsequent years unless extended by legislation.

2. Residential Renewable Energy Tax Credit

This tax credit is specifically designed for homeowners who invest in renewable energy systems. Key features include:

- Allows homeowners to claim a tax credit for installing solar energy systems, wind turbines, and geothermal heat pumps.

- Similar to the ITC, it offers a 26% credit for systems installed before 2023.

3. Energy Efficient Home Credit

The Energy Efficient Home Credit, also known as Section 45L, provides incentives for homebuilders who construct energy-efficient homes. The benefits include:

- A credit of up to $2,000 per home built.

- Eligibility requires homes to meet specific energy-saving standards.

4. Electric Vehicle (EV) Tax Credit

The Electric Vehicle Tax Credit is an incentive for individuals who purchase electric vehicles. Important details include:

- Tax credits can range from $2,500 to $7,500 based on the vehicle’s battery capacity.

- The credit begins to phase out for manufacturers once they sell 200,000 qualifying vehicles.

State and Local Tax Credits

In addition to federal tax credits, many states and local governments offer their own incentives. These can vary significantly depending on your location. Here are some examples:

1. State-Specific Tax Credits

Some states have established their own tax credits to encourage renewable energy adoption. For example:

- California offers a solar tax credit that complements the federal ITC.

- New York has a Residential Solar Tax Credit that provides additional savings.

2. Property Tax Exemptions

Many states offer property tax exemptions for renewable energy installations. This means that the value added to your property by solar panels or wind turbines won’t increase your property tax assessment.

3. Sales Tax Exemptions

Some states exempt renewable energy systems from sales tax, making it cheaper to purchase and install these systems. Check with your local tax authority to see if such exemptions are available in your area.

How to Claim Green Energy Tax Credits

Claiming green energy tax credits involves several steps. Here’s a straightforward process to follow:

1. Determine Eligibility

Before you begin the application process, ensure that you meet the eligibility requirements for the specific tax credit you wish to claim. This may include:

- The type of renewable energy system installed.

- The date of installation.

- Your tax filing status and income level.

2. Gather Necessary Documentation

You will need to collect the following documents:

- Receipts and invoices for the purchase and installation of your renewable energy system.

- Manufacturer certification for the equipment used.

- Any relevant state or local documentation if applicable.

3. Complete the Appropriate Tax Forms

Depending on the credit, you may need to fill out specific forms when filing your taxes. For instance:

- Form 5695 for residential energy credits.

- Form 8834 for qualified electric vehicle credits.

4. Submit Your Tax Return

Once you have completed the necessary forms and gathered all documentation, submit your tax return. Be sure to keep copies of all documents for your records.

Benefits of Green Energy Tax Credits

The benefits of taking advantage of green energy tax credits extend beyond mere financial savings. Here are some notable advantages:

1. Cost Savings

The most immediate benefit is the cost savings associated with installing renewable energy systems. Tax credits can significantly reduce your overall investment.

2. Increased Property Value

Investing in renewable energy can increase the value of your home. Studies show that homes with solar energy systems tend to sell for more than those without.

3. Energy Independence

By adopting renewable energy solutions, you can reduce your reliance on fossil fuels and contribute to a more sustainable energy future.

4. Contribution to Environmental Protection

Utilizing renewable energy helps decrease greenhouse gas emissions and combat climate change, making it a responsible choice for environmentally-conscious individuals.

Challenges and Considerations

While green energy tax credits offer numerous benefits, there are challenges to consider:

1. Complexity of Regulations

Tax regulations can be complex, and navigating them can be challenging. It is advisable to consult with a tax professional to ensure compliance and maximize your credits.

2. Upfront Costs

Even with tax credits, the initial investment in renewable energy systems can be significant. Consider financing options and incentives available in your area.

3. Availability of Incentives

Tax credits and incentives may change based on legislation. Always stay informed about current laws and potential changes that may affect your eligibility.

Conclusion

Green energy tax credits are a powerful tool for promoting the adoption of renewable energy solutions. By understanding the various types of credits available and how to claim them, you can significantly reduce your costs and contribute to a more sustainable future. Whether you are a homeowner, a business owner, or simply an environmentally-conscious individual, taking advantage of these incentives can lead to significant financial and ecological benefits.

In conclusion, embracing green energy not only helps you save money but also plays a vital role in protecting our planet for future generations. Be sure to explore all available options, stay informed about changes in legislation, and consult with professionals to make the most of your investment in green energy.